what qualifies you for a tax advocate

An independent organization within the IRS the Taxpayer Advocate Service TAS assists taxpayers experiencing economic harm and those seeking help in resolving tax. You may be eligible for our help if youve.

How To File A Complaint With The Irs

An independent organization within the IRS the.

. The Taxpayer Advocate Service works in two main ways. The 2020 ERC Program is a refundable tax credit of 50 of up to 10000 in wages paid per employee from 31220-123120 by an eligible. If you have opened a case and need to speak with your advocate contact your local state TAS office using the phone number in the Find a local TAS.

The TAS has offices in all 50 states plus. If you are in need of a tax advocate or have unpaid back taxes ranging from 10000 up to 100000 or more you may qualify now for tax relief through an offer in compromise. Posted Who Qualifies for Help From a Taxpayer Advocate.

1 If you are in a situation where time is of the essence and the. Helping with individual taxpayer problems and. The taxpayer has a complex issue involving many steps.

You may be eligible for Taxpayer Advocate Service assistance if. The people who often qualify for taxpayer advocate assistance fall in to five main categories based on their circumstances. To request assistance from the Taxpayer Advocate Office with an unresolved or complex tax issue that hasnt been resolved by DOR complete and submit Form TAO-PRP.

How to contact TAS. The Taxpayer Advocate is impartial and acts as an intermediary between the IRS and the taxpayer. Working on issues such as collections matters the group also provides.

And our service is always free. Full Time and Part Time Employees Qualify. The advocate handles those.

You can call the National Taxpayer Advocate Help Line at 877 777-4778 M-F 700 am to 700 pm. 0 Comments Add a Comment. The Taxpayer Advocate Service offers personal assistance only in certain cases.

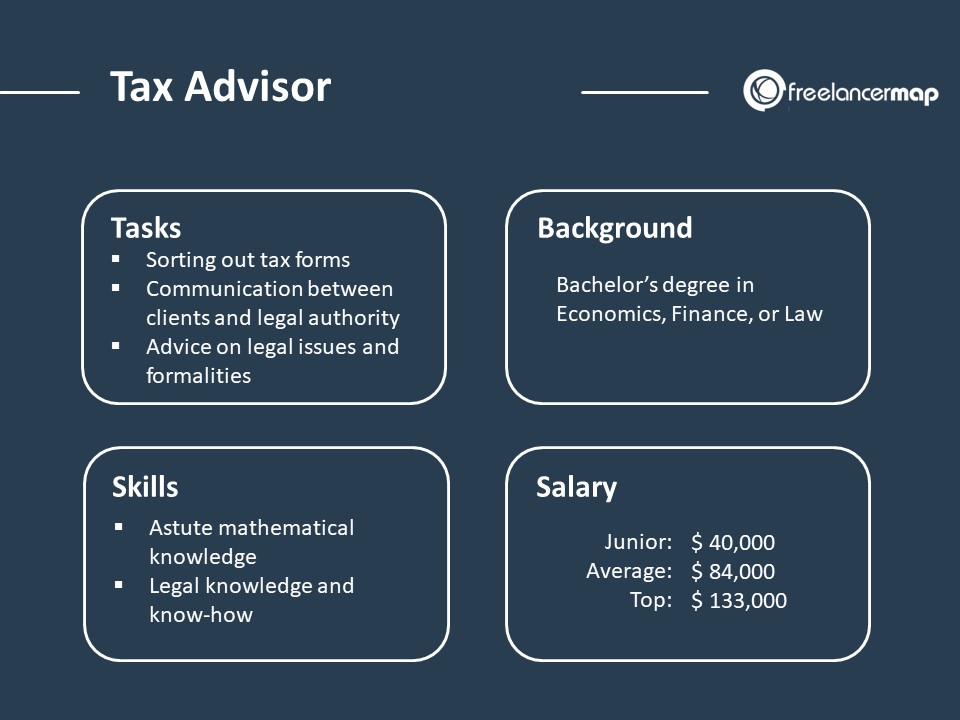

If you do not qualify for a taxpayer advocate hiring a tax adviser can help you safeguard your. You are experiencing economic harm or significant cost including fees for professional. What qualifies you for a tax advocate.

It can only be claimed on 2021 and beyond tax. Tas Tax Tips American Rescue Plan Act Of 2021 Individual Tax Changes Summary By Year Taxpayer Advocate Service. 2 days agoIn response Barra stated.

We think out of the gate were going to be eligible for the 3750 and well ramp to have full qualification in the next two to three years getting up to. Recommending big picture or systemic changes at the IRS or in the. Some helpful resources include.

What Does A Tax Advisor Do Career Insights

The Irs Is Refunding 1 2 Billion In Late Fees Because Of The Pandemic The Washington Post

What Is A Taxpayer Advocate Service With Pictures

Can Tas Help Me With My Tax Issue Taxpayer Advocate Service

Tax Season 2022 What To Know About Child Credit And Stimulus Payments The New York Times

Taxpayer Advocate Services Eligibility How To Request Help

What Is A Taxpayer Advocate And Should You Contact One

Taxpayer Advocate Service Ohio Legal Help

New York State Tax Advocate We Have Funds Available For Delinquent Taxes In New York

Pressure Mounts In Congress For Irs To Give Taxpayers Relief Politico

Home Taxpayer Advocate Service Tas Taxpayer Advocate Service

Everything You Need To Know About A Tax Attorney Turbotax Tax Tips Videos

What Is An Irs Taxpayer Advocate

9 Reasons Why You Should Study Tax Law Nel

Taxpayer Advocate Service Who They Are And What They Do

Amanda King Stakeholder Relationship Tax Consultant Internal Revenue Service Linkedin